Self-employment comes with many financial responsibilities, including paying self-employment tax. This tax is similar to the Social Security and Medicare taxes that are deducted from the paychecks of traditional employees. However, self-employed individuals are responsible for paying both the employer and employee portions of these taxes.

Keeping track of expenses and deductions is essential for self-employed individuals to minimize their tax liability. The self-employment tax and deduction worksheet can help individuals calculate their taxable income and determine what deductions they are eligible for.

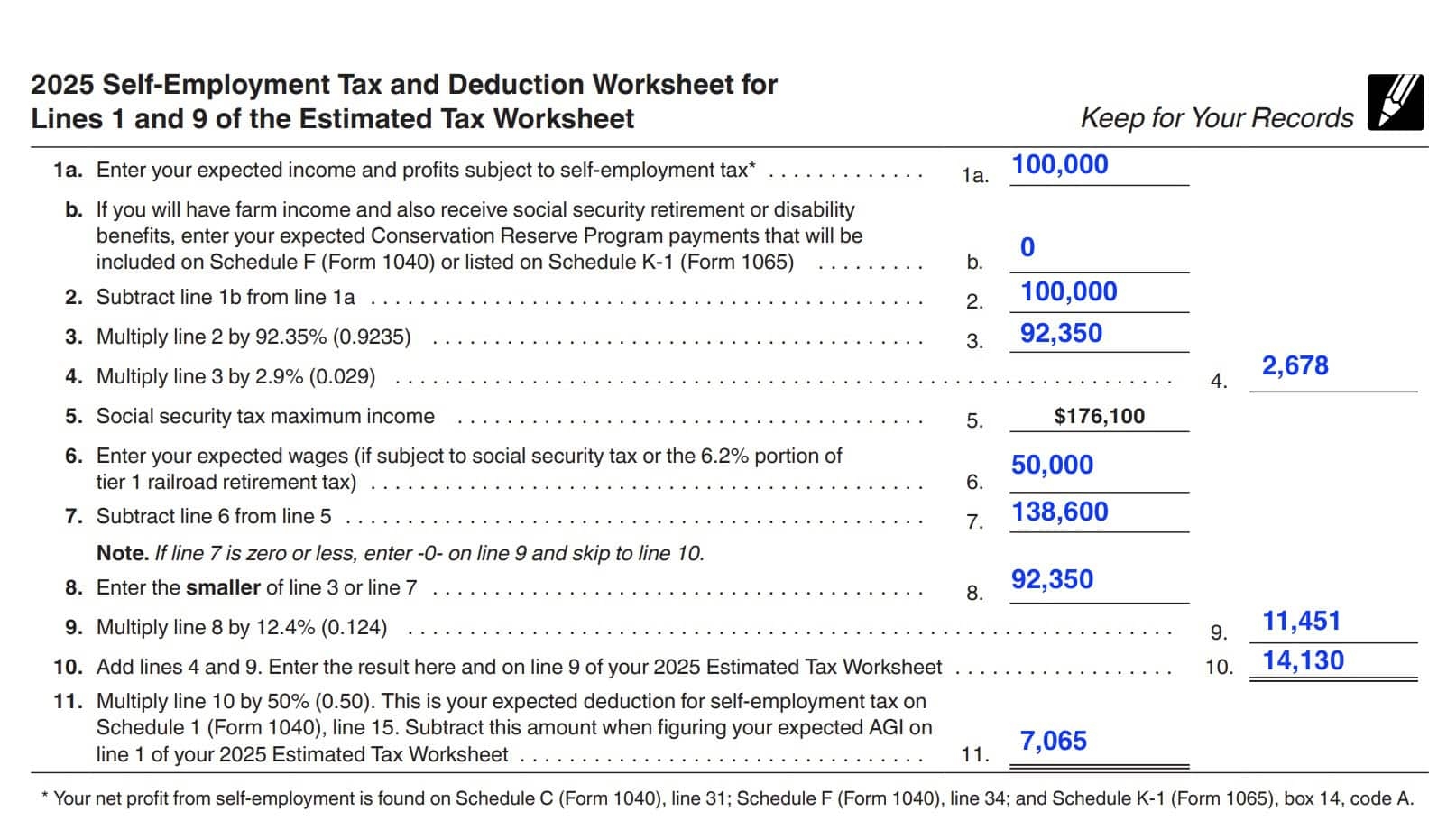

Self Employment Tax and Deduction Worksheet

The self-employment tax and deduction worksheet is a tool that self-employed individuals can use to calculate their tax liability and identify potential deductions. This worksheet typically includes sections for income, expenses, deductions, and tax calculations.

When filling out the worksheet, individuals should gather all necessary financial documents, such as income statements, receipts for business expenses, and records of any estimated tax payments made throughout the year. By accurately reporting income and expenses, individuals can ensure they are not overpaying on their taxes.

Common deductions that self-employed individuals may be eligible for include expenses related to operating their business, such as office supplies, travel expenses, and marketing costs. Additionally, individuals may be able to deduct a portion of their home expenses if they use a home office for their business.

It is important for self-employed individuals to keep detailed records of their income and expenses throughout the year to make filling out the tax worksheet easier. By staying organized and up-to-date with their financial information, individuals can maximize their deductions and reduce their taxable income.

Once the self-employment tax and deduction worksheet is completed, individuals can use the information to accurately file their taxes and determine how much they owe in self-employment tax. By taking advantage of available deductions, self-employed individuals can save money and ensure they are in compliance with tax laws.

In conclusion, self-employment tax and deduction worksheets are valuable tools for self-employed individuals to calculate their tax liability and identify potential deductions. By keeping accurate records and utilizing available deductions, individuals can minimize their tax liability and maximize their savings.