As we approach the tax season for 2022, it’s important to start preparing your tax documents early to avoid any last-minute stress. One key aspect of your tax return is the Schedule A tax and interest deduction worksheet, which helps you calculate your itemized deductions for the year.

By carefully filling out this worksheet, you can potentially lower your taxable income and save money on your taxes. It’s essential to understand how to navigate this worksheet to maximize your deductions and ensure accuracy in your tax return.

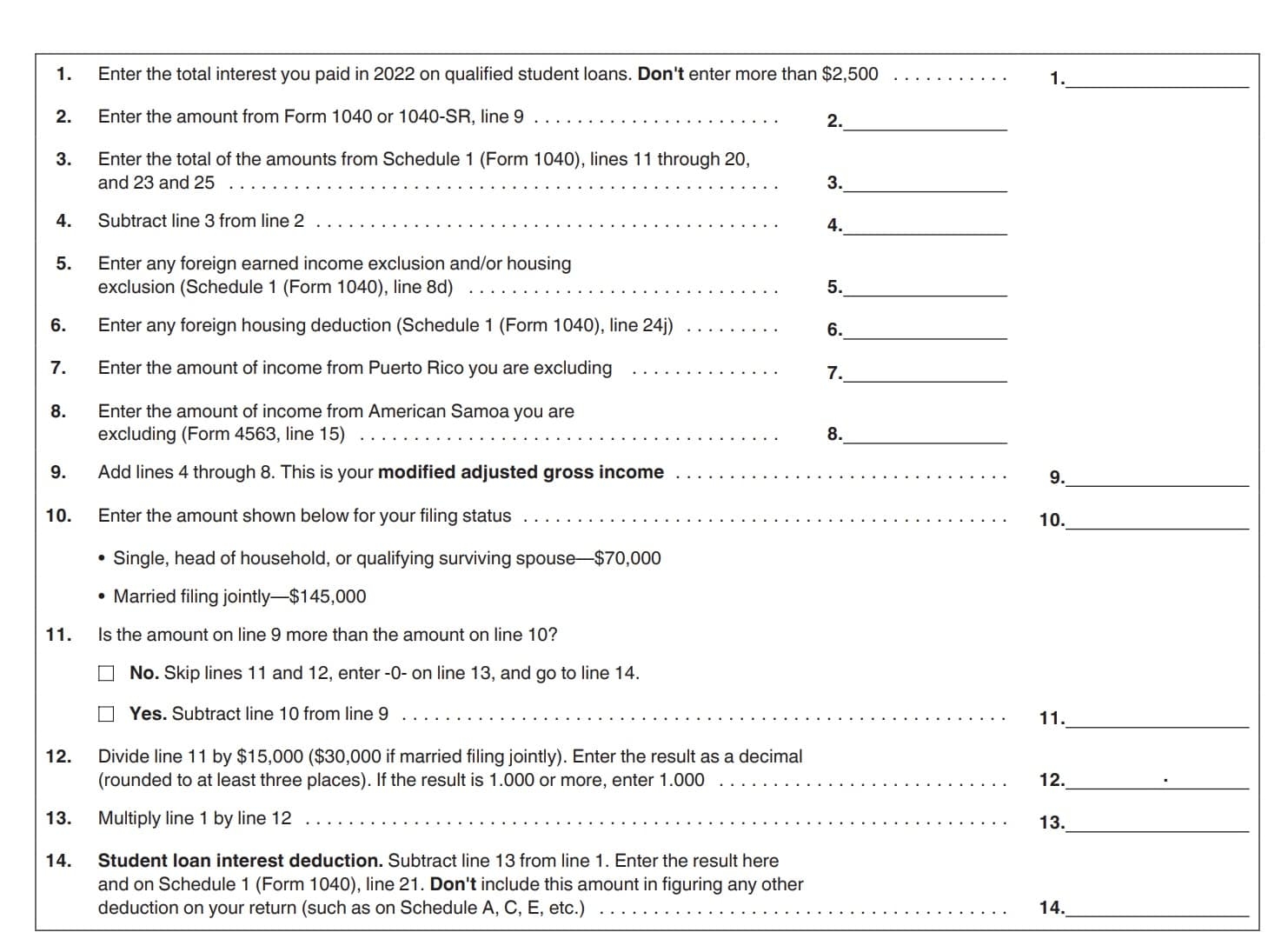

Schedule A Tax and Interest Deduction Worksheet 2022

The Schedule A tax and interest deduction worksheet for 2022 includes various categories of deductions, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions. To effectively utilize this worksheet, you’ll need to gather all relevant documentation, such as receipts, statements, and records of your expenses throughout the year.

Start by entering your total income at the top of the worksheet and then proceed to input your deductible expenses in the corresponding categories. Be sure to follow the instructions provided on the worksheet to ensure accurate calculations and avoid any errors that could result in penalties or audits.

One key benefit of using the Schedule A worksheet is that it allows you to deduct a wide range of expenses that may not be covered by the standard deduction. This can significantly reduce your taxable income and ultimately lower your tax liability, providing you with potential savings on your tax bill.

After completing the worksheet, double-check your entries and calculations to ensure accuracy before filing your tax return. It’s also a good idea to consult with a tax professional or use tax preparation software to help guide you through the process and maximize your deductions.

Overall, the Schedule A tax and interest deduction worksheet for 2022 is a valuable tool for taxpayers looking to lower their tax burden and take advantage of available deductions. By carefully filling out this worksheet and keeping detailed records of your expenses, you can ensure that you’re making the most of your tax return and potentially saving money in the process.

As you prepare for the upcoming tax season, be sure to allocate time to complete the Schedule A worksheet and explore all available deductions to optimize your tax return for 2022.