When it comes to calculating your taxes, it’s important to understand the different types of income and how they are taxed. Qualified dividends and capital gains are two types of income that are subject to special tax rates, which can help you minimize your tax liability. Line 16 of the Capital Gain Tax Worksheet is where you can calculate the tax on these types of income.

Qualified dividends are dividends that meet certain criteria set by the IRS. These dividends are taxed at a lower rate than ordinary dividends, which are taxed at your regular income tax rate. Capital gains are the profits you make from selling assets such as stocks, bonds, or real estate. Like qualified dividends, capital gains are also taxed at a lower rate than ordinary income.

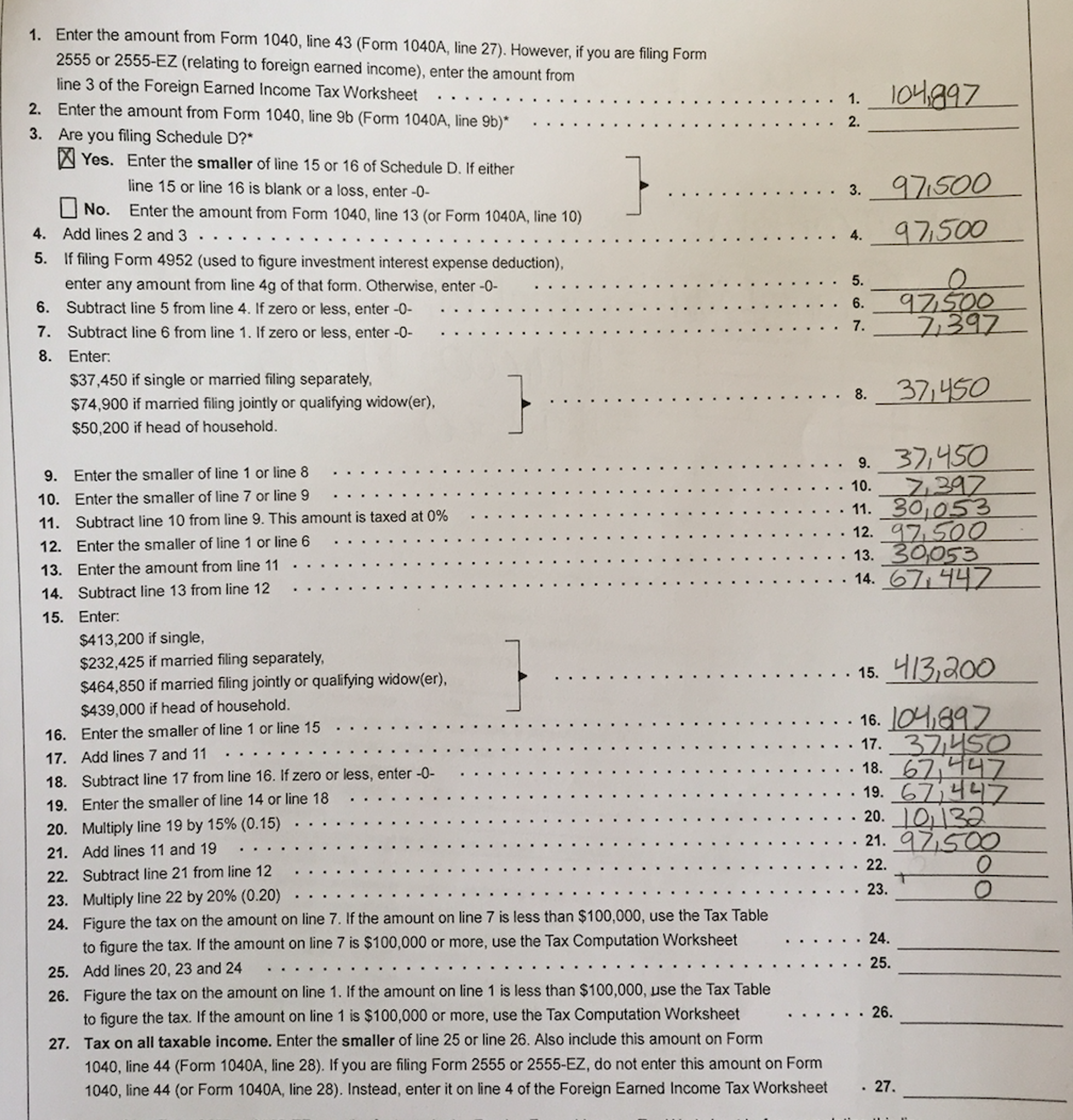

Qualified Dividends and Capital Gain Tax Worksheet Line 16

Line 16 of the Capital Gain Tax Worksheet is where you calculate the tax on your qualified dividends and capital gains. To do this, you will need to fill out the worksheet provided by the IRS, which takes into account your total income, deductions, and any other adjustments you may have. The worksheet helps you determine the tax rate applicable to your qualified dividends and capital gains.

Once you have filled out the worksheet and determined the tax rate, you can use this information to calculate the tax due on your qualified dividends and capital gains. This amount will then be entered on line 16 of the Capital Gain Tax Worksheet, along with any other taxes owed on other types of income.

By understanding how qualified dividends and capital gains are taxed and how to calculate the tax on these types of income using the Capital Gain Tax Worksheet, you can take advantage of the lower tax rates and potentially reduce your overall tax liability. It’s important to accurately complete the worksheet and ensure that you are taking advantage of all available deductions and credits to minimize your tax bill.

In conclusion, qualified dividends and capital gains are subject to special tax rates that can help you save money on your taxes. By using the Capital Gain Tax Worksheet and correctly calculating the tax on line 16, you can ensure that you are taking full advantage of these lower rates and minimizing your tax liability.