When it comes to managing your finances and taxes, understanding the concept of capital loss carryover is crucial. It allows you to offset capital gains with capital losses from previous years, ultimately reducing your tax liability. The Capital Loss Carryover Worksheet for 2023 is a tool that helps you keep track of these losses and calculate how much you can carry forward to future years.

Capital losses occur when you sell an investment for less than you paid for it. These losses can be used to offset capital gains, reducing the amount of tax you owe. However, if your capital losses exceed your capital gains in a given year, you can carry over the remaining losses to future years, up to certain limits. This is where the Capital Loss Carryover Worksheet comes into play.

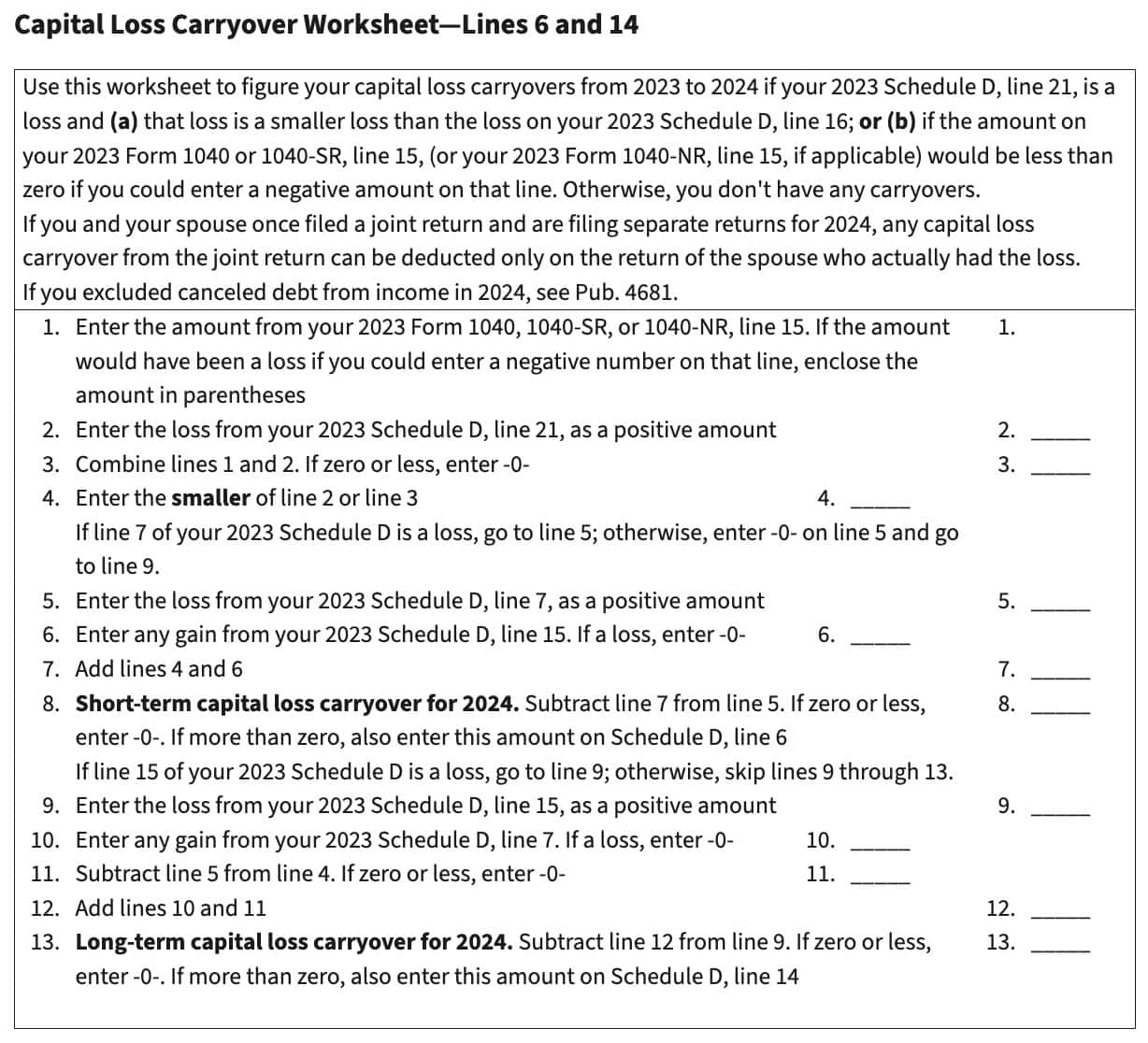

Capital Loss Carryover Worksheet 2023

The Capital Loss Carryover Worksheet for 2023 is a tool provided by the IRS to help taxpayers calculate and track their capital losses from previous years. It allows you to determine the amount of capital losses that can be carried forward to offset future capital gains. By filling out this worksheet accurately, you can ensure that you are maximizing your tax benefits and minimizing your tax liability.

When using the Capital Loss Carryover Worksheet, you will need to gather information on your capital gains and losses from previous years. You will then calculate the net capital gain or loss for each year, taking into account any carryover amounts from prior years. The worksheet will guide you through the process of determining how much of your capital losses can be carried forward to the next tax year.

It’s important to note that there are specific rules and limitations when it comes to carrying over capital losses. For example, you can only deduct up to $3,000 of capital losses in a single tax year, with any remaining losses carried forward to future years. Additionally, the worksheet will help you keep track of any long-term and short-term capital losses separately, as they are treated differently for tax purposes.

By utilizing the Capital Loss Carryover Worksheet for 2023, you can take control of your tax planning and ensure that you are making the most of your capital losses. It’s a valuable tool that can help you minimize your tax liability and maximize your overall financial health. Be sure to consult with a tax professional if you have any questions or need assistance with completing the worksheet.

In conclusion, the Capital Loss Carryover Worksheet for 2023 is an essential tool for managing your capital losses and offsetting future gains. By understanding how to use this worksheet effectively, you can optimize your tax strategy and make informed financial decisions. Take the time to fill out the worksheet accurately and seek guidance from a tax professional if needed to ensure you are maximizing your tax benefits.