Capital gains tax is a tax imposed on the profits that an individual or entity earns from the sale of an asset such as stocks, bonds, or real estate. Calculating capital gains tax can be complex, but using a capital gains tax worksheet can help simplify the process.

By filling out a capital gains tax worksheet, taxpayers can determine the amount of capital gains they have realized and the corresponding tax liability. This worksheet includes information about the cost basis of the asset, the sale price, and any adjustments or deductions that may apply.

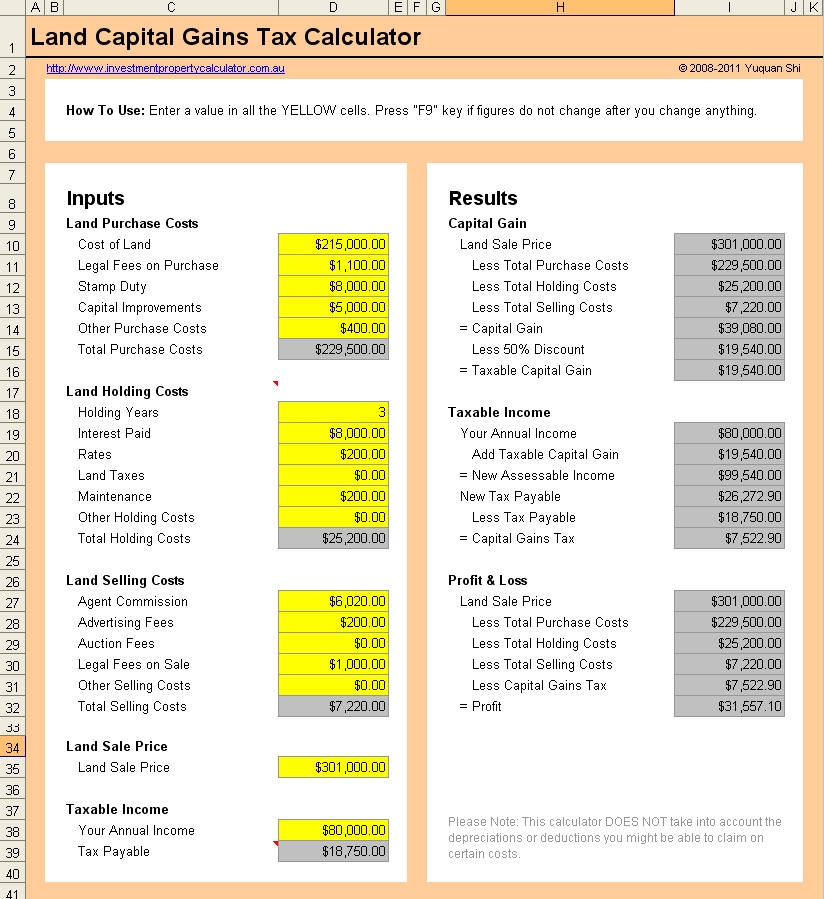

Capital Gains Tax Worksheet

The capital gains tax worksheet typically consists of several sections that guide taxpayers through the calculation process. First, individuals need to determine the cost basis of the asset, which includes the purchase price, any additional costs such as commissions, and adjustments for dividends or stock splits.

Next, taxpayers must calculate the net proceeds from the sale of the asset, which is the sale price minus any selling expenses or fees. The difference between the net proceeds and the cost basis represents the capital gain, which is subject to taxation at a specific rate depending on the holding period of the asset.

It is important to accurately complete the capital gains tax worksheet to avoid under or overpaying taxes. Taxpayers should consult with a tax professional or use online tax calculators to ensure that they are correctly reporting their capital gains and maximizing any deductions or credits available to them.

Once the capital gains tax worksheet is completed, individuals can determine the total tax liability and make any necessary payments to the IRS. By staying organized and keeping detailed records of asset transactions, taxpayers can effectively manage their capital gains tax obligations and avoid any potential penalties or audits.

In conclusion, the capital gains tax worksheet is a valuable tool for individuals and entities to calculate and report their capital gains tax liability accurately. By following the steps outlined in the worksheet and seeking professional advice when needed, taxpayers can ensure compliance with tax laws and optimize their tax strategies.