As a student, managing finances can be a challenging task. With tuition fees, textbooks, rent, and other expenses piling up, it’s important to have a budget in place to ensure financial stability. Budgeting worksheets are a useful tool that can help students track their expenses, set financial goals, and make informed decisions about their spending.

By using budgeting worksheets, students can gain a better understanding of their income and expenses. This can help them identify areas where they can cut back on spending and save money for future expenses or emergencies. Budgeting worksheets also provide a visual representation of their financial situation, making it easier to see where their money is going and how they can make adjustments to their budget.

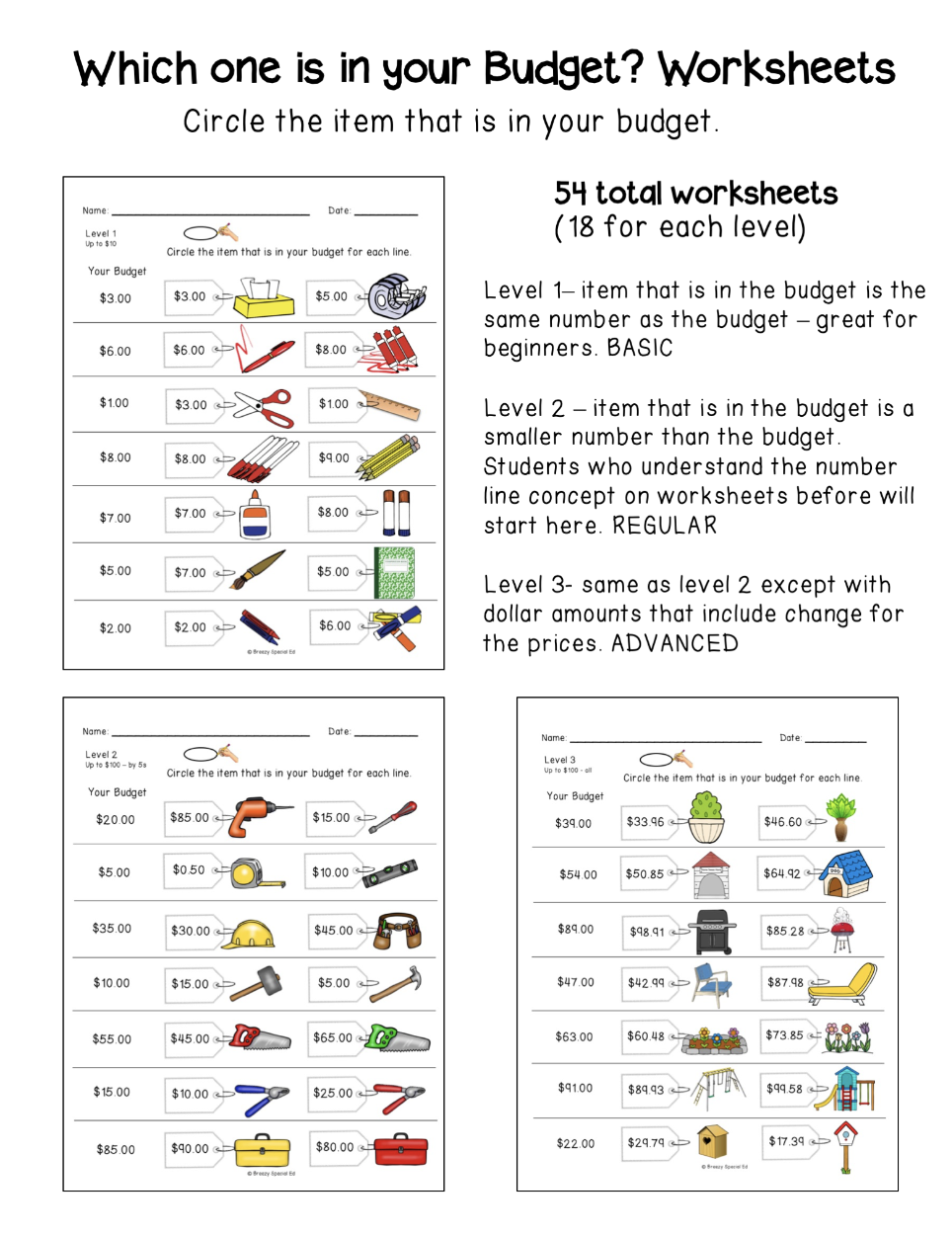

Budgeting Worksheets for Students

There are a variety of budgeting worksheets available for students to use, ranging from simple templates to more detailed spreadsheets. These worksheets typically include categories for income, expenses, savings, and debt. Students can input their financial information into these worksheets and track their spending on a monthly basis.

Some budgeting worksheets also include sections for setting financial goals, such as saving for a trip or paying off student loans. By setting specific and achievable goals, students can stay motivated to stick to their budget and make smarter financial decisions. These worksheets can also help students track their progress towards their goals and make adjustments as needed.

In addition to tracking expenses and setting goals, budgeting worksheets can also help students plan for future expenses, such as textbooks, rent, and utilities. By having a clear picture of their finances, students can avoid overspending and ensure they have enough money set aside for their upcoming expenses. This can help reduce financial stress and improve overall financial well-being.

Overall, budgeting worksheets are a valuable tool for students to manage their finances effectively. By using these worksheets, students can gain a better understanding of their financial situation, set achievable goals, and make informed decisions about their spending. With proper budgeting and financial planning, students can build a strong financial foundation for their future.