When it comes to claiming the Employee Retention Tax Credit (ERTC), proper documentation is key. The ADP ERTC Supporting Documentation Worksheet is a tool designed to help businesses organize and track the necessary information to support their ERTC claim. This worksheet can be a valuable resource for businesses looking to take advantage of this tax credit.

As businesses navigate the complexities of the ERTC program, having a clear and organized system for documenting eligible expenses and employee information is essential. The ADP ERTC Supporting Documentation Worksheet provides a structured template for businesses to input and track this information, making the process of claiming the ERTC more manageable.

ADP ERTC Supporting Documentation Worksheet

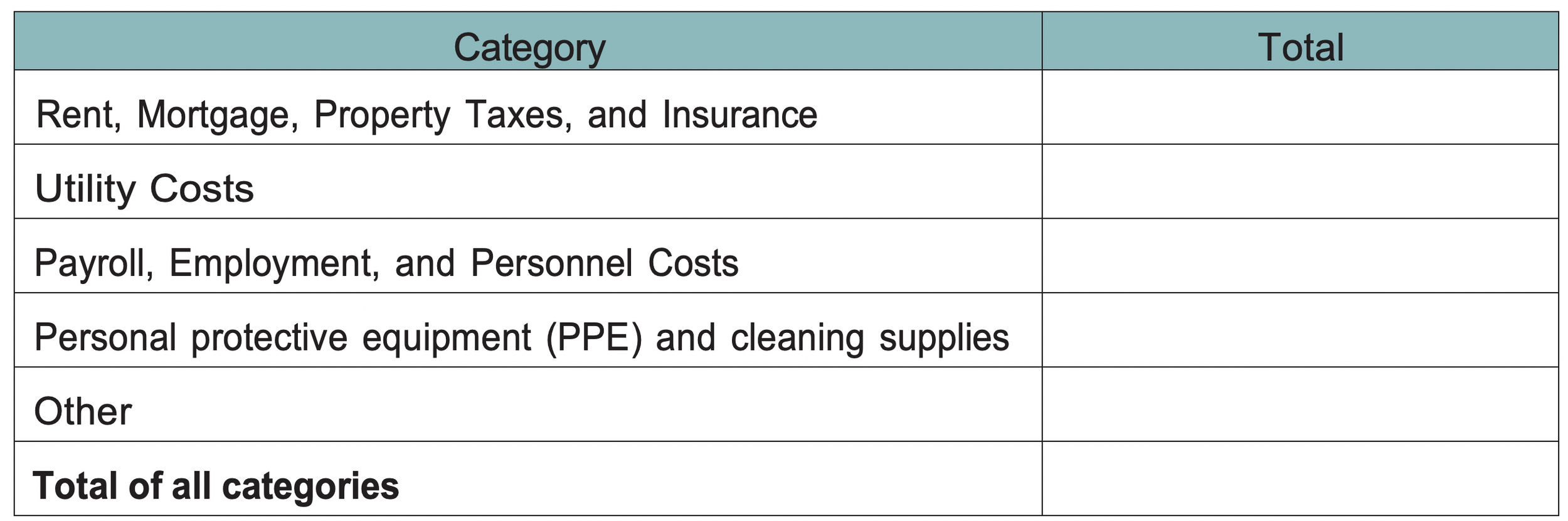

The ADP ERTC Supporting Documentation Worksheet includes sections for documenting various types of information required for the ERTC claim. This may include details on eligible wages, qualified health plan expenses, and the number of full-time employees during the applicable periods. By filling out this worksheet accurately and completely, businesses can ensure they have the necessary documentation to support their ERTC claim.

In addition to tracking expenses and employee information, the ADP ERTC Supporting Documentation Worksheet can also help businesses identify any gaps or inconsistencies in their documentation. This can be crucial in avoiding potential issues or delays in the ERTC claim process, as well as ensuring compliance with IRS requirements.

By utilizing the ADP ERTC Supporting Documentation Worksheet, businesses can streamline the process of claiming the ERTC and maximize their eligibility for this valuable tax credit. With proper documentation in place, businesses can confidently submit their ERTC claim and potentially benefit from significant tax savings.

In conclusion, the ADP ERTC Supporting Documentation Worksheet is a valuable tool for businesses seeking to claim the Employee Retention Tax Credit. By organizing and tracking the necessary information in a structured manner, businesses can improve their chances of successfully claiming the ERTC and maximizing their tax savings. Utilizing this worksheet can help businesses navigate the complexities of the ERTC program and ensure they have the documentation needed to support their claim.