Creating a budget is an essential part of managing your finances effectively. One of the most popular tools for budgeting is an Excel budget worksheet. This versatile tool allows you to track your income and expenses, set financial goals, and stay on top of your finances.

Excel budget worksheets are easy to use and can be customized to fit your individual financial situation. Whether you are looking to pay off debt, save for a big purchase, or simply track your spending, an Excel budget worksheet can help you stay organized and in control of your finances.

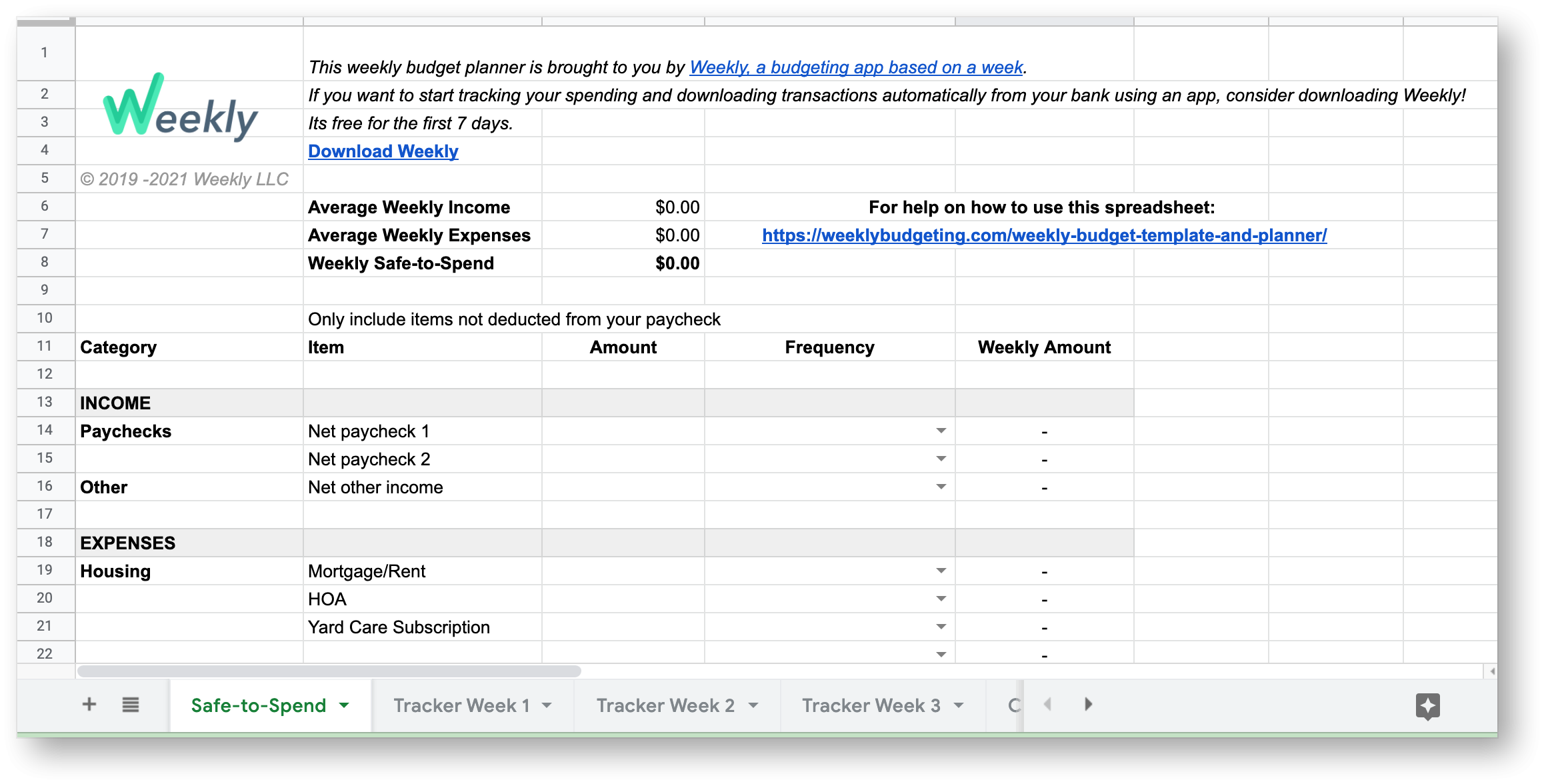

Excel Budget Worksheet

One of the key benefits of using an Excel budget worksheet is the ability to easily track your income and expenses. By entering your income and expenses into the worksheet, you can see where your money is going each month and make adjustments as needed. This can help you identify areas where you may be overspending and find ways to cut back.

In addition to tracking your income and expenses, an Excel budget worksheet can also help you set financial goals and track your progress towards them. Whether you are saving for a vacation, a new car, or a down payment on a house, you can use the worksheet to set realistic goals and track your savings over time.

Another benefit of using an Excel budget worksheet is the ability to create visual representations of your financial data. By using charts and graphs, you can easily see how your income and expenses are changing over time and identify trends that may impact your financial health. This can help you make more informed decisions about your finances and plan for the future.

Overall, an Excel budget worksheet is a powerful tool for managing your finances and staying on track with your financial goals. By tracking your income and expenses, setting realistic goals, and using visual representations of your financial data, you can take control of your finances and make better decisions about your money.

In conclusion, an Excel budget worksheet is a valuable tool for anyone looking to improve their financial situation. By tracking your income and expenses, setting financial goals, and using visual representations of your financial data, you can stay organized and on top of your finances. Consider using an Excel budget worksheet to take control of your finances and reach your financial goals.