Creating a budget worksheet is an essential step in managing your finances effectively. By tracking your income and expenses, you can gain a better understanding of where your money is going and make smarter financial decisions. Whether you are saving for a big purchase, paying off debt, or just trying to stay on top of your bills, a budget worksheet can help you stay organized and on track.

Before you start creating your budget worksheet, it’s important to gather all of your financial information. This includes your monthly income, bills, debts, and any other expenses you may have. Having a clear picture of your financial situation will make it easier to create a realistic and effective budget.

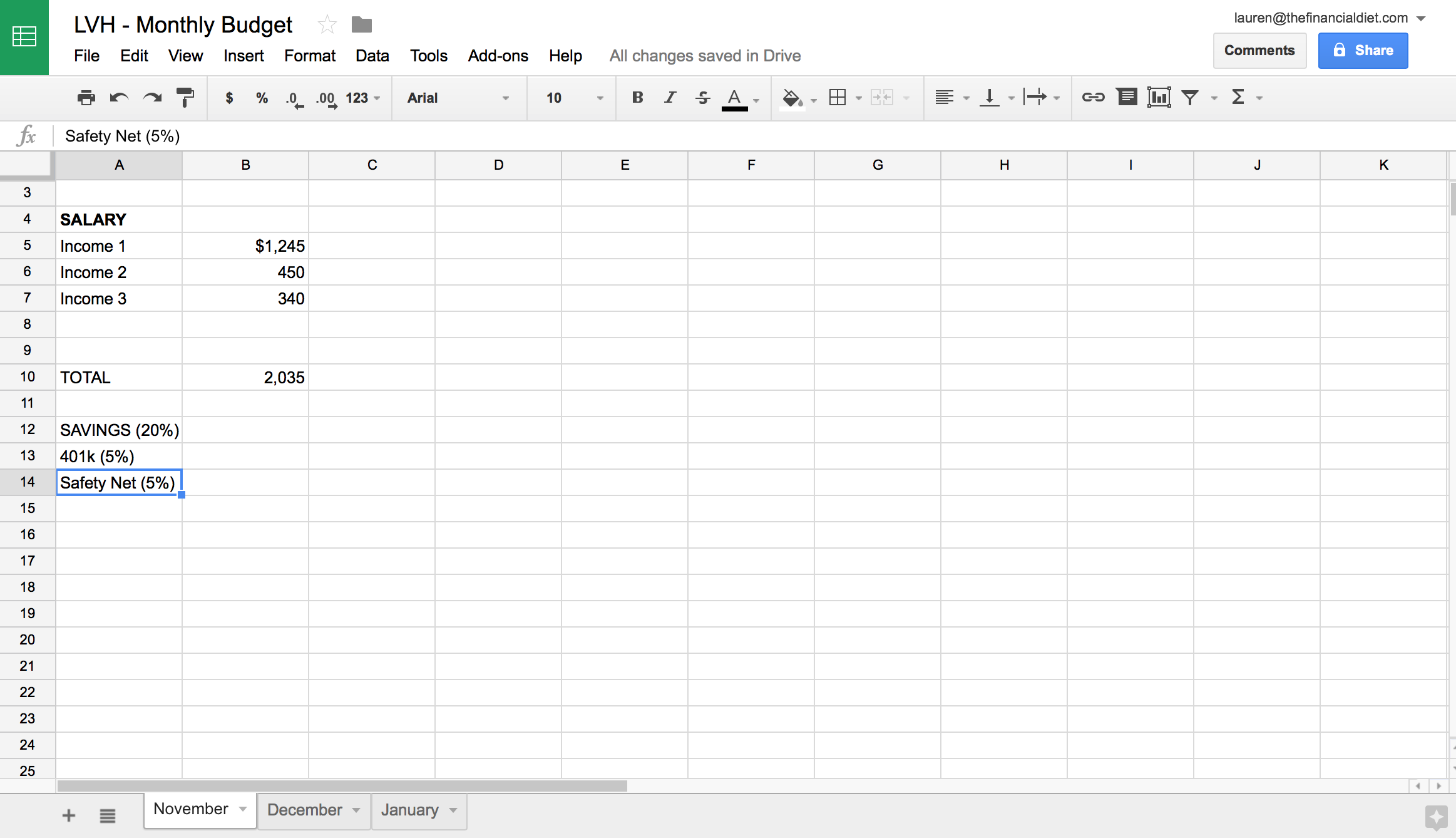

Creating a Budget Worksheet

Start by listing all of your sources of income at the top of the worksheet. This may include your salary, bonuses, freelance work, or any other money you receive on a regular basis. Be sure to include the total amount for each income source, as well as the frequency (weekly, bi-weekly, monthly, etc.).

Next, list all of your monthly expenses, such as rent or mortgage, utilities, groceries, transportation, and entertainment. Be sure to include the total amount for each expense category, as well as the due date or frequency of each bill. This will help you stay on top of your bills and avoid missing any payments.

Once you have listed all of your income and expenses, subtract your total expenses from your total income to determine how much money you have left over each month. This will give you a clear picture of your financial situation and help you identify areas where you can cut back or save more.

Finally, review your budget worksheet regularly to track your progress and make adjustments as needed. If you find that you are consistently overspending in certain areas, look for ways to cut back or find alternative solutions. By staying organized and proactive, you can take control of your finances and work towards your financial goals.

In conclusion, creating a budget worksheet is a valuable tool for managing your finances and achieving your financial goals. By tracking your income and expenses, you can gain insight into your spending habits and make informed decisions about your money. With a clear understanding of your financial situation, you can make smarter choices and work towards a more secure financial future.