When it comes to managing your rental properties or income from partnerships, S corporations, or trusts, it’s essential to keep track of all your expenses and income. This is where the Schedule E Worksheet comes into play. This worksheet is a crucial tool for reporting your rental and royalty income, as well as any expenses associated with it, on your tax return.

By using the Schedule E Worksheet, you can ensure that you are accurately reporting your rental income and expenses to the IRS. This will help you avoid any potential audits or penalties and ensure that you are maximizing your tax deductions.

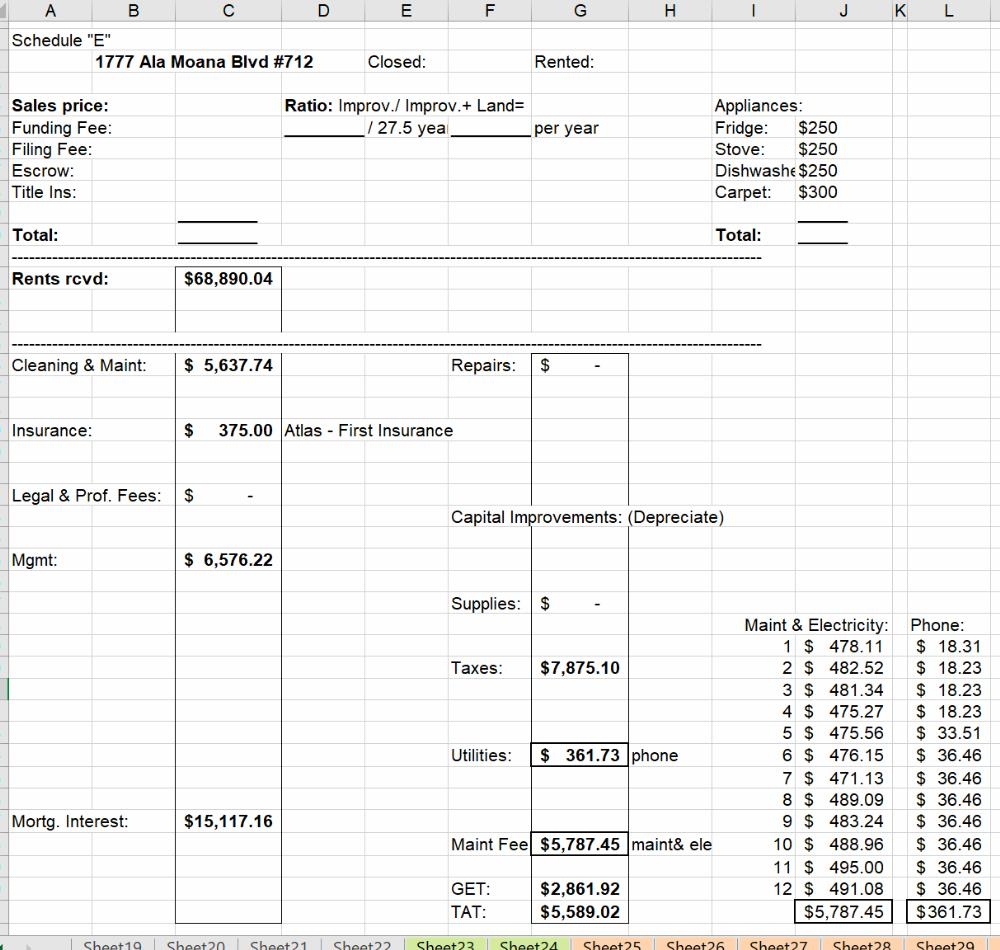

Schedule E Worksheet

The Schedule E Worksheet is a form that is used to report income and expenses related to rental properties, partnerships, S corporations, and trusts. It consists of various sections where you can input information such as rental income, mortgage interest, property taxes, repairs, and other expenses.

When filling out the Schedule E Worksheet, it’s essential to keep detailed records of all your expenses and income throughout the year. This will make it easier to accurately report this information on your tax return and ensure that you are taking advantage of all available deductions.

One of the key benefits of using the Schedule E Worksheet is that it allows you to deduct a wide range of expenses associated with your rental properties or income from partnerships, S corporations, or trusts. This can include mortgage interest, property taxes, insurance, repairs, maintenance, utilities, and even property management fees.

By carefully completing the Schedule E Worksheet and keeping detailed records of all your expenses, you can ensure that you are maximizing your tax deductions and accurately reporting your rental income to the IRS. This will help you stay in compliance with tax laws and avoid any potential issues down the road.

In conclusion, the Schedule E Worksheet is a valuable tool for anyone who has rental properties or income from partnerships, S corporations, or trusts. By using this worksheet to track your income and expenses, you can ensure that you are accurately reporting this information on your tax return and maximizing your tax deductions. So, be sure to keep detailed records and consult with a tax professional if you have any questions about filling out the Schedule E Worksheet.